RBI Assistant Salary & Career Profile

Contents

The RBI Assistant position is widely regarded as one of the most prestigious clerical-level roles in India, offering a blend of high financial compensation, an enviable work-life balance, and structured career progression within the nation’s central bank.

RBI Assistant Salary Structure 2026 (Revised)

Following the latest wage revision, the salary for RBI Assistants has seen a significant jump, making it the highest-paying entry-level clerical job in the banking sector.

1. Monthly Emoluments

The gross monthly salary for an RBI Assistant in 2026 is approximately ₹58,514 (without HRA). If you do not opt for bank accommodation, you receive an additional 15% House Rent Allowance.

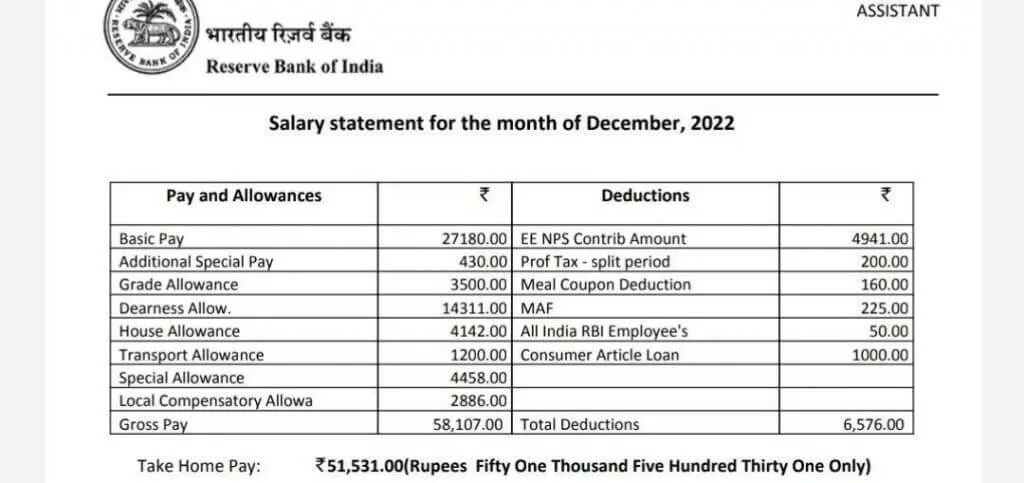

| Component | Amount (Approx.) |

| Basic Pay | ₹29,000 |

| Dearness Allowance (DA) | ₹14,311 |

| House Rent Allowance (HRA) | ₹4,142 (if applicable) |

| Special Allowance | ₹4,458 |

| Grade Allowance | ₹3,500 |

| Local Compensatory Allowance | ₹2,886 |

| Gross Pay | ₹58,514 |

| Deductions (NPS, Tax, etc.) | ~₹6,576 |

| Net In-Hand Salary | ₹51,000 – ₹54,000 |

2. Pay Scale

The revised pay scale is:

₹29000 – 1700 (3) – 34100 – 2040 (4) – 42260 – 2720 (6) – 58580 – 2950 (2) – 64480 – 3370 (3) – 74590 – 4050 (1) – 78640.

RBI Assistant Salary Slip

The salary slip of an experienced RBI Assistant employee currently working at Reserve Bank of India is attached below for reference.

Perks and Allowances (The “RBI Advantage”)

Beyond the monthly paycheck, the Reserve Bank provides industry-leading benefits:

- Housing: Subject to availability, RBI provides residential quarters in prime locations (State Capitals).

- Medical: Comprehensive reimbursement for OPD treatments and hospitalization for self and family.

- Concessional Loans: After 2 years of service, employees are eligible for housing, car, and personal loans at highly subsidized interest rates.

- Allowances: Reimbursement for newspaper, briefcase, book grant, and vehicle maintenance for official purposes.

- Leave Fare Concession (LFC): Travel reimbursement for the employee and dependents once every two years.

Job Profile & Responsibilities

As an RBI Assistant, your role is primarily administrative, focused on supporting the smooth functioning of various central bank departments:

- Data Entry & Management: Updating digital records and maintaining ledgers.

- Currency Management: Assisting in the issue, circulation, and verification of currency notes.

- Public Dealing: Handling queries related to banking, currency exchange, and RTI requests.

- Government Treasury Work: Coordinating with higher authorities on treasury and financial stability tasks.

- Office Hours: A standard 9:15 AM to 5:15 PM shift with a 5-day work week (Saturdays and Sundays off).

Career Growth & Promotion Path

RBI offers a transparent and fast-track promotion policy. You are not stuck in a clerical role; you can rise to senior executive positions.

Promotion Process:

- Normal Process: Based on seniority and years of service (usually 3–5 years) + internal exam.

- Merit-Basis Process: Candidates with JAIIB/CAIIB diplomas can appear for internal exams earlier (after 2 years) to jump to officer grades.

Promotion Hierarchy:

- Scale 1: Assistant Manager (Grade A)

- Scale 2: Manager (Grade B)

- Scale 3: Assistant General Manager (Grade C)

- Scale 4: Deputy General Manager (Grade D)

Strategic Tip for 2026

With only 650 vacancies nationwide, the competition is intense. Focus on English and Reasoning for the Mains, as these sections often differentiate toppers. Additionally, since most postings are in State Capitals, ensure you are fully proficient in the local language of the region you apply for, as the Language Proficiency Test (LPT) is mandatory.